- why the normal distribution is so popular

- how fat the tails really are

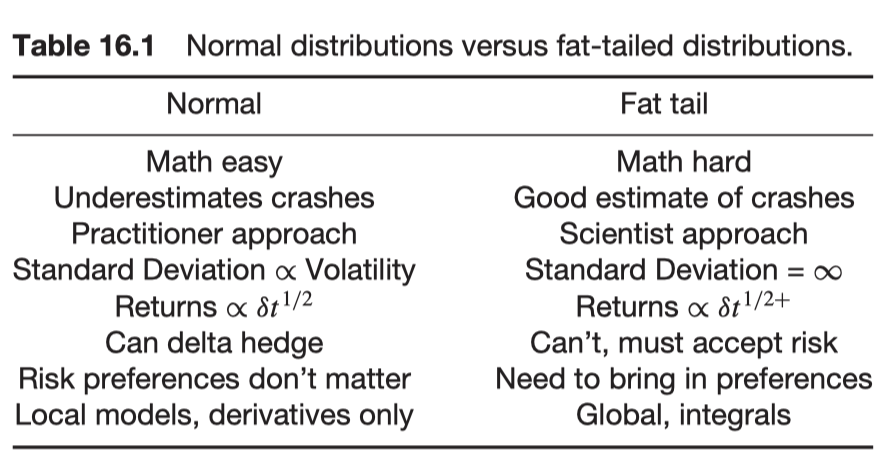

- what dropping the normal assumption entails

Introduction

The normal distribution allows us to make enormous advances because it comes with a lot of relatively easy-to-use analytical tools. However, the normal distribution vastly underestimates stock crashes probability.

Why we like the normal distribution: the central limit theorem

The central limit theorem (CLT) states: ’Given a distribution with a mean m and variance

By ‘sampling distribution of the mean’ is meant

where the

Perhaps stock price daily returns should be normal since you ‘add up’ thousands of returns during each day.

And since the normal distribution only has the 2 parameters, the mean and the variance, it follows that the skew and kurtosis etc. of the building-block distribution don’t much matter to the final distribution.

The conditions under the central limit theorem is valid.

- The building-block distributions must be identical (you aren’t allowed to draw from different distributions each time)

- Each draw from the building-block distribution must be independent from other draws

- The mean and standard deviation of the building-block distribution must both be finite

Normal versus lognormal

Lognormality that relies only on the Central limit theorem

The stock price

Since

Does my talk look fat in this?

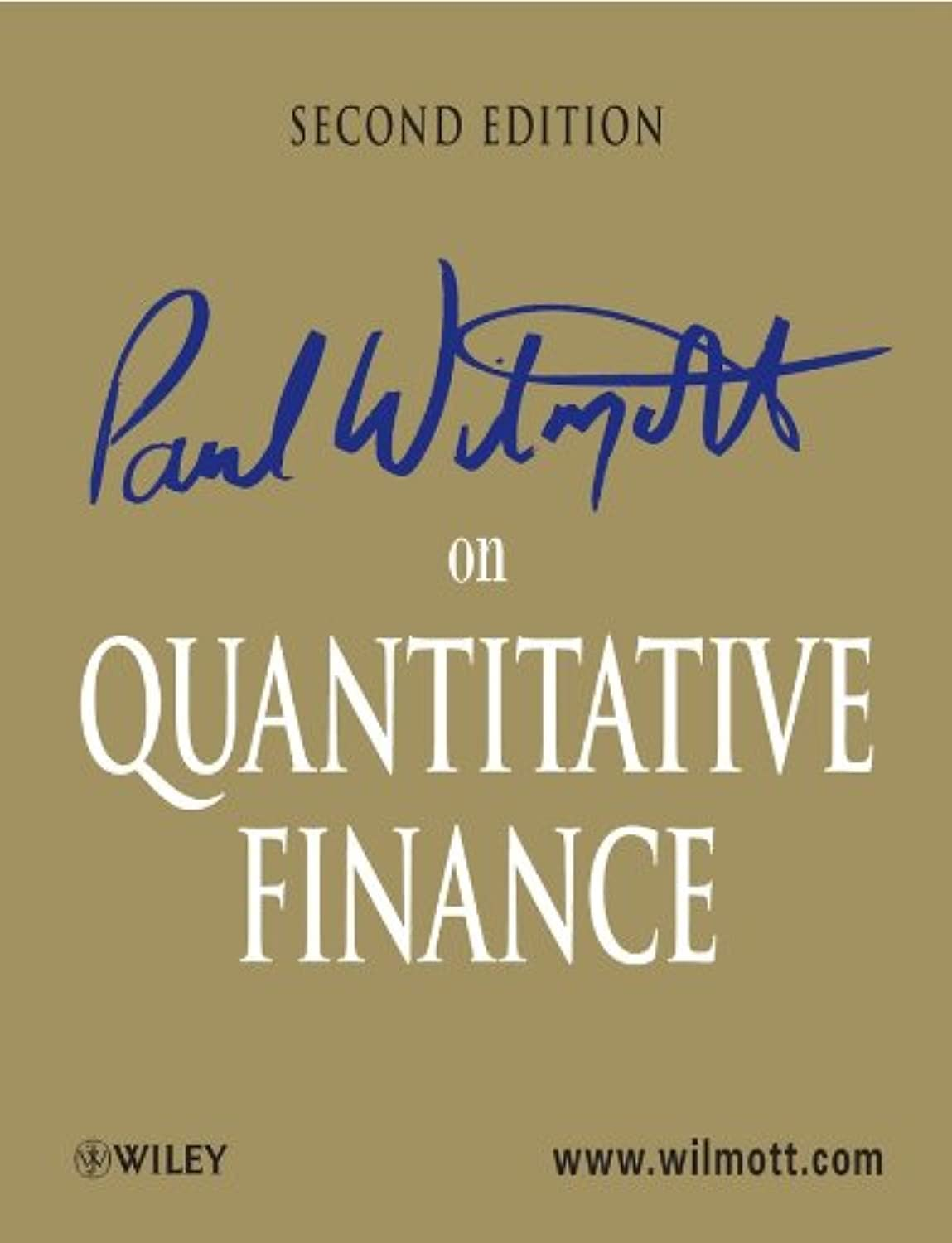

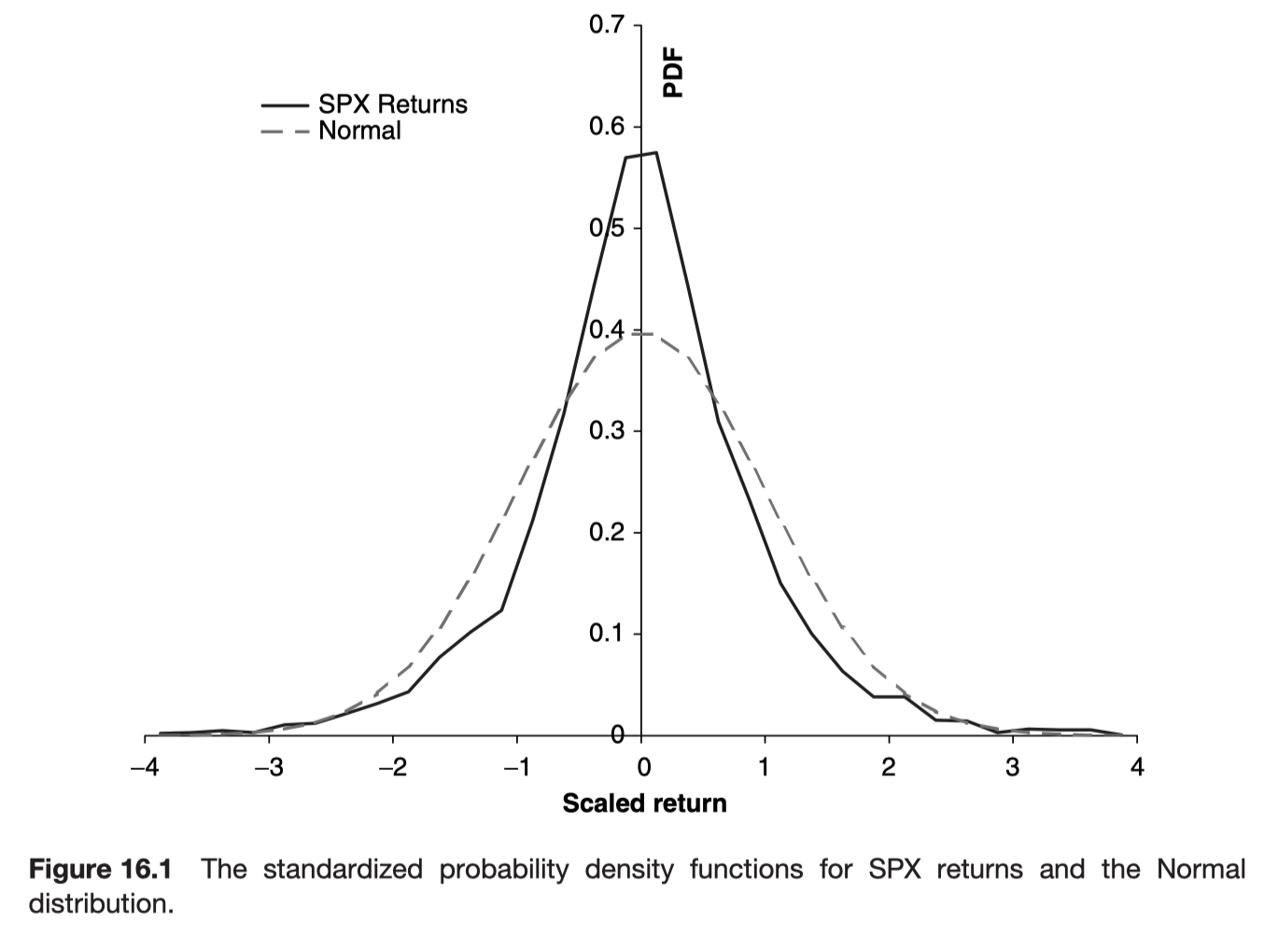

There is evidence, and lots of it, that tails of returns distributions are fat.

The empirical peak is higher than the normal distribution and the tails are both fatter.

Probability of a 20% SPX fall: empirical

Since we working with 24 years of daily data, we could argue that empirically the probability of a 20% fall in the SPX is one in 24 * 252, or 0.000165.

Probability of a 20% SPX fall: theoretical

To get a theoretical estimate, based on normal distributions, we must first estimate the daily standard deviation for SPX returns. Over that period it was 0.0106, equivalent to an average volatility of 16.9%. Theoretical answer: once very

Use a different distribution, perhaps

Serial autocorrelation

Another reason why the normal distribution might not be relevant is if there is any serial autocorrelation in stock price returns from trade to trade, or day to day. Serial autocorrelation means the correlation between the return one day and the return the previous day.

Again there is evidence that there is such autocorrelation, perhaps not that strong on average, but over certain periods, especially intra day, the effect is enough to scupper the normal distribution.

Further reading