The duration of a security with price P is the (negative of the ) percentage sensitivity of the price P to a small parallel shift in the level of interest rates. That is, let r(t, T) be the continuously compounded term structure of interest rates at time t. Consider a uniform shift of size dr across rates that brings rates to

Given a duration

Let A and a be two constants and x be a variable. Let

Lets

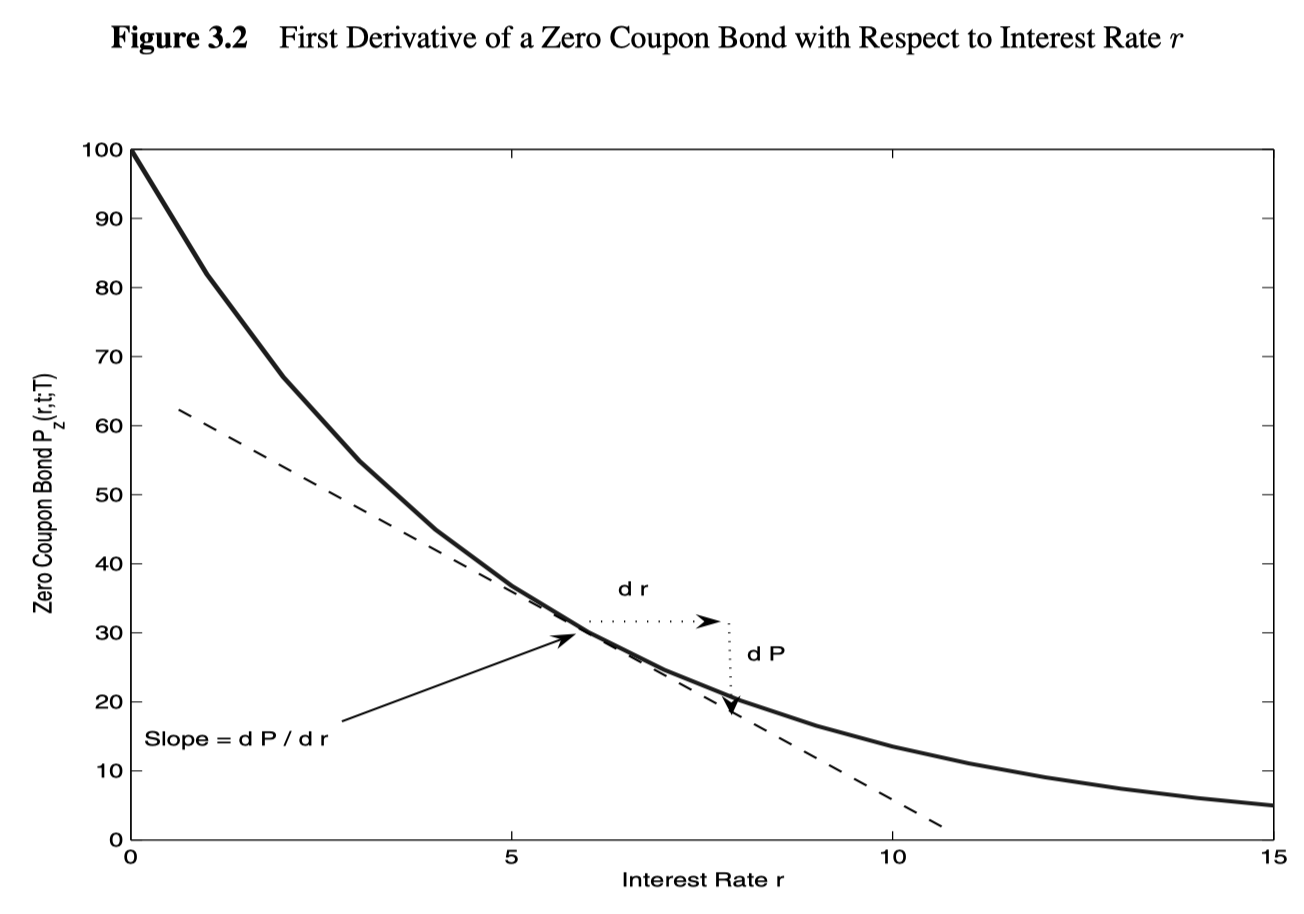

Visually, the first derivative represents the slope of the curve

Duration of a zero coupon bond

Duration of a portfolio

The duration of portfolio of n securities is given by

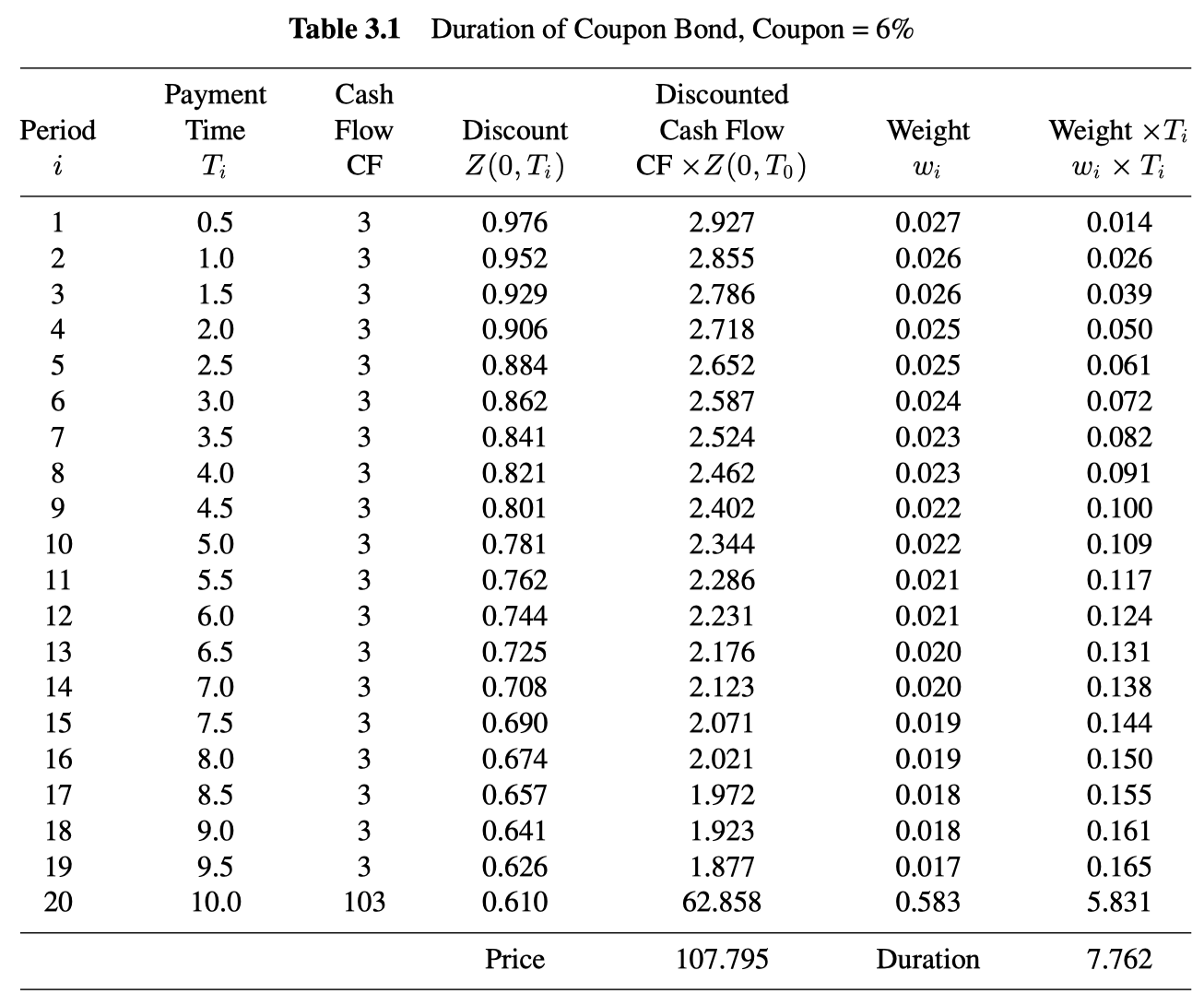

Duration of a coupon bond

Duration and average time of cash flow payments

While we have derived the formula for duration from the definition of duration as the percentage sensitivity of a security to changes in interest rates, some confusion sometimes arises about the notion of duration because sometimes people define duration as the average time of payments. These two interpretations are equivalent for fixed rate bonds, that is, bonds that pay fixed coupons.

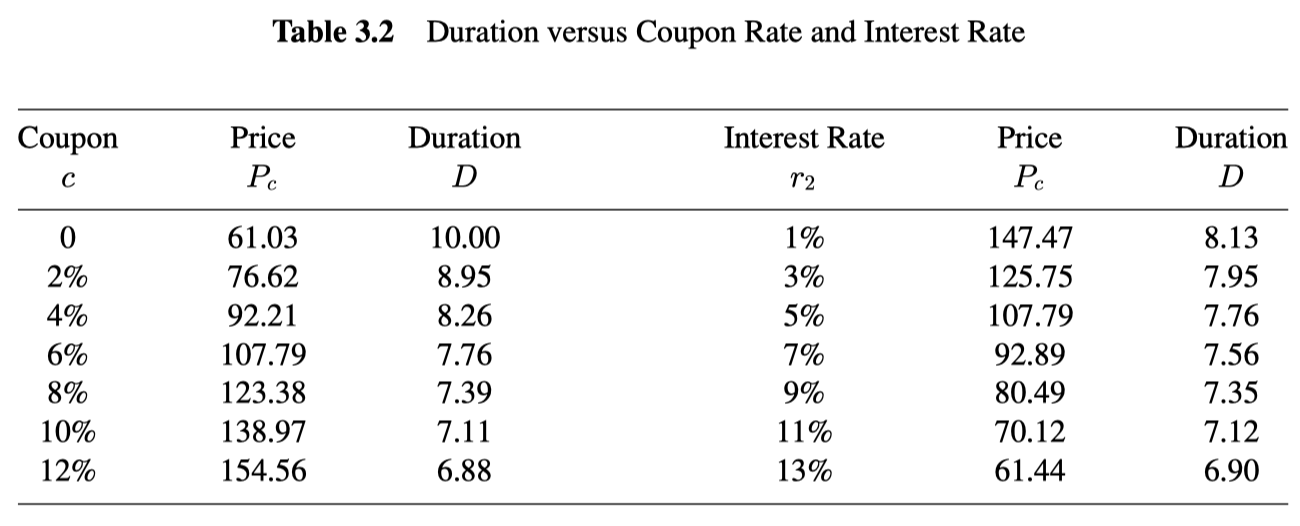

Properties of duration

- lower average time of cash flow payments: the higher the coupon, the larger are the intermediate coupons relatively. Thus, the average time of coupon payments gets closer to today.

- lower sensitivity to interest rates: the higher the coupon rate, the larger are cash flows in the near future compared to the long-term future. Cash flows that arrive sooner rather than later are less sensitive to changes in interest rates. Thus, an increase in coupon rate implies an overall lower sensitivity to changes in discount rates.

Traditional definitions of duration

The duration is not defined against the continuously compounded interest rate but rather against the semi-annually compounded yield to maturity. In this case, the definition of the modified duration as the (negative of the) sensitivity of prices to changes in interest rates does not correspond exactly to the simple formulas derived earlier, and a small adjustment is needed.

Macaulay duration - the weighted average of cash flow maturities

The duration of zero investment portfolio: dollar duration

For z non-zero valued security or portfolio with price P, the relation between duration and dollar duration is

The dollar duration of portfolio of n securities

The price of a basis point of a security with price P is defined

Duration and value-at-risk

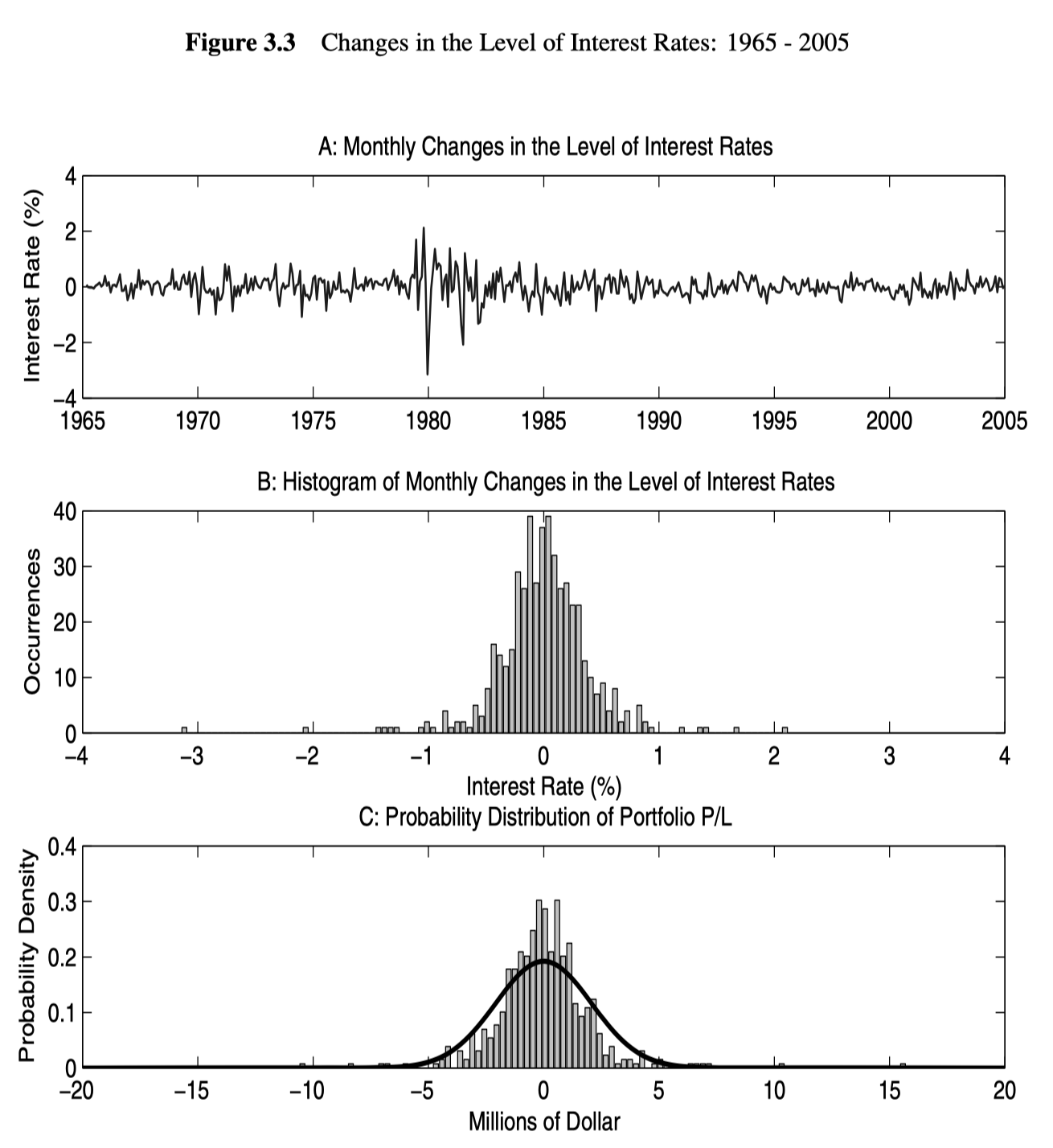

Value-at-Risk (VaR) is a risk measure that attempts to quantify the amount of risk in a portfolio. In brief, VaR answers the following question: with 95% probability, what is the maximum portfolio loss that we can expect within a given horizon, such as a day, a week or a month?

Let

Through duration, we can estimate the sensitivity of a portfolio of fluctuations in the interest rate.

Let dr have a normal distribution with mean

Warnings

- VaR is a statistical measure of risk, and as with any other statistical measure, it depends on distributional assumptions and the sample used for the calculation. The difference can be large.

- The duration approximation is appropriate for small parallel changes in the level of interest rates. However, by definition, VaR is concerned with large changes. Therefore, the duration approximation method is internally inconsistent.

- The VaR measures the maximum loss with 95% probability. However, it does not say anything about how large the losses could be if they do occur.

- The VaR formula includes the expected change in the portfolio

Duration and expected shortfall

Expected shortfall - This measure of risk answers the following question: how large can we expect the loss of a portfolio to be when it is higher than VaR?

The expected shortfall is the expected loss on a portfolio P over the horizon T conditional on the loss being larger than the (100 -

The expected shortfall contains the same information as the VaR, as the only difference is the coefficient that multiplies